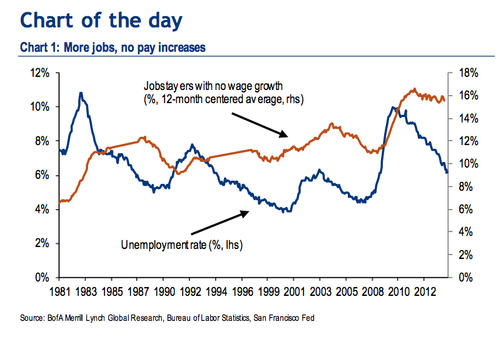

One of the surprising things about the current economic recovery is that while unemployment is falling, wage growth on a national level is almost non-existent (see chart below). Granted, in the berry business on the Central Coast, our labor issues are more complex as they involve economic improvement in Mexico as well as competition for workers from the hospitality and construction industries (and subsequently wages have been creeping up for the last couple of years), but nevertheless I think it's important enough to understand the bigger picture that we spend a moment on it.

Let's go then to a recent speech given by Federal Reserve Chairwoman Janet Yellen, which goes some ways to explain what is happening here.

The excerpt below is pretty dense, but I'll summarize it for you in three points:

1. Wages were not cut very much during the Great Recession, meaning that they well could have been unrealistically high over the past few years of economic recovery. Which means that right now wages might have finally reached an appropriate level, so employers are still not having raise wages too much to attract qualified workers.

2. Productivity in this economic up cycle has been rising faster than wages, implying that the real cost of labor has been falling - in other words saying that while the economy is strong thanks in part to gains in productivity, wages haven't necessarily needed to follow. Importantly, looking forward, these gains in productivity may continue to persist, meaning that large wage gains might not be in the offing for quite some time into the future.

3. Conversely, watch for the possibility of wage gains even though full employment hasn't yet been reached. Some workers who have been unemployed for a while might have difficulty getting back even though they are actively looking because their skill set isn't in step with what is now needed. As communicated to me by a city official, this might in fact be the case in Watsonville, which still has an unemployment rate of around 15% even though the local agricultural economy is quite strong.

For those interested in the details, here is the excerpt:

"…since wage movements have historically been sensitive to tightness in the labor market, the recent behavior of both nominal and real wages point to weaker labor market conditions than would be indicated by the current unemployment rate.

There are three reasons, however, why we should be cautious in drawing such a conclusion. First, the sluggish pace of nominal and real wage growth in recent years may reflect the phenomenon of “pent-up wage deflation.” The evidence suggests that many firms faced significant constraints in lowering compensation during the recession and the earlier part of the recovery because of “downward nominal wage rigidity”–namely, an inability or unwillingness on the part of firms to cut nominal wages. To the extent that firms faced limits in reducing real and nominal wages when the labor market was exceptionally weak, they may find that now they do not need to raise wages to attract qualified workers. As a result, wages might rise relatively slowly as the labor market strengthens. If pent-up wage deflation is holding down wage growth, the current very moderate wage growth could be a misleading signal of the degree of remaining slack. Further, wages could begin to rise at a noticeably more rapid pace once pent-up wage deflation has been absorbed.

Second, wage developments reflect not only cyclical but also secular trends that have likely affected the evolution of labor's share of income in recent years. As I noted, real wages have been rising less rapidly than productivity, implying that real unit labor costs have been declining, a pattern suggesting that there is scope for nominal wages to accelerate from their recent pace without creating meaningful inflationary pressure. However, research suggests that the decline in real unit labor costs may partly reflect secular factors that predate the recession, including changing patterns of production and international trade, as well as measurement issues. If so, productivity growth could continue to outpace real wage gains even when the economy is again operating at its potential.

A third issue that complicates the interpretation of wage trends is the possibility that, because of the dislocations of the Great Recession, transitory wage and price pressures could emerge well before maximum sustainable employment has been reached, although they would abate over time as the economy moves back toward maximum employment. The argument is that workers who have suffered long-term unemployment–along with, perhaps, those who have dropped out of the labor force but would return to work in a stronger economy–face significant impediments to reemployment. In this case, further improvement in the labor market could entail stronger wage pressures for a time before maximum employment has been attained.

H/T http://www.thereformedbroker.com/

Thanks Josh!

Attached Images: