Posts Tagged: Giannini Foundation

Pork prices may reflect uncertainty around Prop 12

California's farm animal welfare act, approved in 2018, fully implemented in January 2024 after delays

Since being passed by California voters in 2018, Proposition 12, a farm animal welfare law, has faced a series of legal challenges that have led to uncertainty and delays in the implementation and enforcement of its requirements for the treatment of breeding pigs. A new Special Issue of ARE Update sheds light on its contentious path to eventual full implementation on Jan. 1, 2024, and analyzes how these delays have affected the retail and wholesale pork market.

Preliminary data suggest that Prop 12, and the uncertainty surrounding it, have led to an average retail price increase of 20% for covered pork products (i.e., those included under the regulation, mainly uncooked cuts of pork), as well as significantly higher prices for wholesale pork products during the implementation period and as hog farms nationally continue to adjust to the law.

Prop 12, officially known as the “Prevention of Cruelty to Farm Animals Act,” was approved by 63% of California voters. The law requires housing standards for egg-laying hens, veal calves and breeding pigs for the eggs or meat of these animals or their offspring to be sold in California.

While these standards first went into effect for egg-laying hens and veal calves as early as Jan. 1, 2020, many farms and businesses were hesitant to make large investments in the sow housing and traceability requirements until legal issues were settled for Prop 12-compliant pork.

On May 11, 2023, the U.S. Supreme Court upheld Prop 12. As a result, and consistent with rulings of the Sacramento Superior Court in California, California began requiring Prop 12-compliant pork on July 1, 2023, while allowing remaining non-compliant pork already in the supply chain to be sold until Jan. 1, 2024. Although full enforcement began almost eight months after the Supreme Court ruling, hog farms, almost all of which are outside California, continue to expand the supply of pork from hogs born of mother pigs that meet California housing and treatment standards.

“A long complicated process is not uncommon for major regulations,” said Daniel A. Sumner, a study co-author and distinguished professor in the UC Davis Department of Agricultural and Resource Economics.

Economists Hannah Hawkins, Shawn Arita and Seth Meyer with the U.S. Department of Agriculture's Office of the Chief Economist have been documenting prices and quantities of hogs and pork as the industry has adjusted to Prop 12. Using Circana retail scanner data, they found that in the past nine months covered pork products sold in California increased in price compared to the rest of the United States. While there was significant price fluctuation between the partial and full implementation dates, the initial price impacts were higher than would be expected after full adjustment, with price increases of 16% for bacon and 41% for pork loin.

Based on USDA Agricultural Marketing Service data, the authors found that wholesale prices for compliant pork cuts also increased substantially during the adjustment period, with an average price premium of 22%. Due to the many delays in implementation, Prop 12-compliant pork volumes are not yet sufficient to meet quantities that would have been demanded without these significant price increases. As the industry catches up to supply sufficient quantities of compliant pork meat to meet the California demand and a new market equilibrium is reached, both retail and wholesale prices may settle at lower price premiums. However, we may still be several months away from understanding the full impact of Prop 12 on meat and egg producers and consumers.

To learn more about the implementation of Prop 12 and its impact on the retail and wholesale pork market, read the full Special Issue of ARE Update 27(3), UC Giannini Foundation of Agricultural Economics, online at https://giannini.ucop.edu/filer/file/1710543749/20936/.

ARE Update is a bimonthly magazine published by the Giannini Foundation of Agricultural Economics to educate policymakers and agribusiness professionals about new research or analysis of important topics in agricultural and resource economics. Articles are written by Giannini Foundation members, including University of California faculty and Cooperative Extension specialists in agricultural and resource economics, and university graduate students. Learn more about the Giannini Foundation and its publications at https://giannini.ucop.edu/.

Did California’s ag overtime law help farmworkers?

After AB 1066, ag workers see average hours, wages fall

Proponents of California's agricultural overtime law, AB 1066, have called it a victory for farmworkers, while critics have asserted that it will harm the very people it was designed to protect. New research by Alexandra Hill, UC Cooperative Extension specialist and assistant professor in UC Berkeley's Department of Agricultural and Resource Economics, shows that, on average, there has been a decrease in worker hours and wages.

Her estimates suggest that in the first two years of its implementation, California's farmworkers worked a total of 15,000 to 45,000 fewer hours and earned a total of $6 million to $9 million less on their weekly paychecks than they would have without this law in place.

In 2016, California passed Assembly Bill 1066, legislation that removed existing overtime exemptions for farmworkers in the Fair Labor Standards Act. The FLSA is the federal law that mandates many employment conditions, including overtime standards. In non-exempt industries, it requires that employers pay 1.5 times an employee's regular pay rate for any hours worked beyond 40 hours per week.

Prior to AB 1066, agricultural workers in California were entitled to overtime pay for hours worked beyond 60 hours per week, but AB 1066 changed this beginning in 2019. The law mandated a gradual phase-in (over four years) of reduced overtime thresholds (lowering the weekly hours threshold by 5 hours/week each year) until agricultural employees are subject to the same overtime standards as workers in other industries (40 hours/week).

Many farmers feared that this new policy would drive food prices up, push them out of business, or force a faster transition to mechanization. Most reported that they would reduce hours for individual workers to remain below the new overtime standards and avoid paying the higher rates.

However, media, advocacy groups, and others heralded the law as a major win for farmworkers, as it would provide workers with more fair compensation for long workweeks. While long-term effects of the law for farmers and farmworkers remain to be seen, Hill's work sheds light on the early effects of the law on worker hours and earnings.

Using worker-reported hours from the National Agricultural Workers Survey both before and in the two years after the law went into effect (2019 and 2020), economist Hill explored the effects of AB 1066. Overall, she finds that worker hours and earnings decreased as an effect of the legislation.

Her work highlights that the share of workers working 56–60 hours/week, just below the old overtime threshold, decreased by roughly half. Most of these workers shifted to working fewer hours; the share working 46–50 hours/week, just below the new (as of 2020) overtime threshold, increased by roughly one-third. She found similar reductions in worker earnings.

The share of the workforce with higher weekly earnings (between $600 and $800/week) decreased by roughly one-third, with most of these workers shifting into a lower earnings bracket of $400–$500/week. These changes in hours and pay are consistent with employers behaving as they claimed they would – by cutting hours to avoid paying overtime rates.

Hill notes that these decreases in average wages and hours may be positive for those who want more leisure time and may – due to shorter workdays and weeks – improve workplace safety. However, she also warns that this can be detrimental for “workers and their families who were depending on this lost income to cover living expenses (and who) may now need to seek out second employment opportunities, negating these other benefits and adding the inconvenience of traveling between jobs.”

To learn more about the effects of AB 1066 on California farmworkers, read the full article by Hill: “California's Overtime Law for Agricultural Workers: What Happened to Worker Hours and Pay?” online at https://giannini.ucop.edu/publications/are-update.

ARE Update is a bimonthly magazine published by the Giannini Foundation of Agricultural Economics to educate policymakers and agribusiness professionals about new research or analysis of important topics in agricultural and resource economics. Articles are written by Giannini Foundation members, including University of California faculty and Cooperative Extension specialists in agricultural and resource economics, and university graduate students. Learn more about the Giannini Foundation and its publications at https://giannini.ucop.edu.

Is inflation here to stay?

If energy price spikes and supply chain disruptions continue, inflation expected to persist

In January 2022, inflation reached its highest yearly increase at 7.5% in nearly 40 years. But are these high rates here to stay, or are they only a temporary symptom of COVID-19 and the recent supply chain-related disruptions?

Economists from UC Davis, Bar-Ilan University, and the London School of Economics analyzed financial markets that trade in the risk of inflation to show how expectations of long-term inflation have changed over the last year. They found that between November 2020 and November 2021, there was over a tenfold increase in the probability of average inflation lying above 3% over the next five years, suggesting that many expect inflation to persist.

Inflation, as measured by the Consumer Price Index (CPI), has risen dramatically over the last year. Gas prices hit a new all-time high in November 2021, with inflation for food at home, electricity, and new vehicles at 6.5%, 6.3%, and 11.8%, respectively, in December. Rising oil and natural gas prices, higher personal savings and increased consumer demand coming out of the lockdown, and a sluggish supply chain coming out of the pandemic may all be partially to blame for inflation over the last year.

As pent-up demand slows and supply chains adapt, their impact on inflation may also subside. But, if the energy price spike in response to the invasion of Ukraine persists and if supply disruptions continue, it could lead consumers to demand higher wages to increase their purchasing power.

“If companies raise prices in response to higher wage demands by workers, leading to further high expectations of inflation, further wage demands, and so on, then the United States could enter the wage-price spiral that is often at the heart of high and persistent inflation,” said Jens Hilscher, associate professor in the Department of Agricultural and Resource Economics at UC Davis.

To better understand the likelihood of long-term inflation, Hilscher and co-authors Alon Raviv, senior lecturer at Bar-Ilan University, and Ricardo Reis, A.W. Phillips Professor of Economics at the London School of Economics, looked to the financial markets that trade in contracts that pay off if inflation rises above a given cutoff (with one cutoff at 3% and another at 4% — both well above the Federal Reserve's target of 2% inflation per year). Assessing the payoffs of these two types of contracts allowed them to determine the probability of the average inflation being above 3% or 4% over the next five years.

They found that between November 2020 and November 2021, the probability of an average inflation of 3% jumped from 6.1% to 66.2%, while the probability of an average inflation of 4% rose from 1.6% to 14.1%, a dramatic increase.

Long-term inflation leads to higher uncertainty, making long-term planning harder for businesses and individuals alike. It also leads to lenders experiencing a loss in the real value of the money they are repaid. Over time, these factors lead lenders to charge higher interest rates to account for uncertainty and potential losses. In turn, access to credit will suffer.

Hilscher noted, “A central bank that is very committed to a stable inflation target can always bring inflation down, even if only by causing a recession. We will see over the next several months which risk the Fed perceives to be the greater threat to our economy.”

To learn more about the risk of long-term inflation, read the full article “Inflation Risks are on the Rise,” by Hilscher, Raviv and Reis published by UC Giannini Foundation of Agricultural Economics in ARE Update 25(3): 9–11, free online at https://giannini.ucop.edu/filer/file/1645718420/20317.

ARE Update is a bimonthly magazine published by the Giannini Foundation of Agricultural Economics to educate policymakers and agribusiness professionals about new research or analysis of important topics in agricultural and resource economics. Articles are written by Giannini Foundation members, including University of California faculty and Cooperative Extension specialists in agricultural and resource economics, and university graduate students. Learn more about the Giannini Foundation and its publications at https://giannini.ucop.edu.

‘Containergeddon’ at ports cost California farmers $2.1 billion in exports

New research estimates economic losses due to congestion, inefficiencies

Between wildfires, drought, a trade war and the COVID-19 pandemic, the last few years have been hard on California farmers. But recent research by agricultural economists from UC Davis and the University of Connecticut suggests that economic losses to California agriculture from recent supply chain disruptions may have an even greater economic impact.

In an article titled “‘Containergeddon' and California Agriculture,” researchers estimate that there was a 17% decline in the value of containerized agricultural exports between May and September 2021, resulting from recent port congestion. This amounts to around $2.1 billion in lost foreign sales, which exceeds losses from the 2018 U.S.-China trade war.

By the peak of the disruption in September 2021, nearly 80% of all containers leaving California ports were empty – about 43% fewer filled containers leaving California's ports than there were prior to the pandemic. And since 40% of filled shipping containers leaving California's ports are filled with U.S. agricultural products – around a third of which are from California – farmers in the state experienced significant lost export opportunities.

By September 2021, there were around 25,000 fewer containers filled with agricultural products leaving California ports than there were in May 2021. Processed tomatoes, rice, wine and tree nuts saw the sharpest average trade declines.

“We calculated California tree nut producers lost about $520 million,” said Colin Carter, UC Davis Distinguished Professor of agricultural and resource economics. “This was followed by wine with a loss of more than $250 million and rice with about $120 million lost.”

During the pandemic, an increase in household savings led to increases in consumer spending, with many of these additional goods being imported from Asia. California ports were overwhelmed by the added shipping containers coming in from Asia. At times, bottlenecks at Southern California ports left more than 80 vessels waiting off the coast to unload. Docks and warehouses ran out of space and the turnaround time for shipping containers nearly doubled.

Increased U.S. demand for imported goods from Asia also led to increased demand for empty shipping containers in Asia. Prior to the pandemic, freight rates for shipping containers from Shanghai to Los Angeles were already higher than the return trip from Los Angeles, but this gap widened significantly after COVID-19. By September 2021, the fee to ship a 40-foot container from Shanghai to Los Angeles had increased sixfold to $12,000 – while the return trip from Los Angeles was only $1,400.

The high prices for containers from Asia, coupled with shipping delays from the high volume of imported goods entering California ports, made it more profitable for shippers to return containers to Asia empty, rather than waiting at the ports to have them loaded with U.S. exports for the return trip.

“If port inefficiencies persist, the ramifications for California agriculture will extend beyond the immediate loss of foreign sales, as importers begin to view California as an unreliable supplier of agricultural products,” Carter said.

To learn more about the supply chain disruptions at California ports, and their effect on California agriculture, read the full article by Colin Carter (Distinguished Professor in the Department of Agricultural and Resource Economics at UC Davis), Sandro Steinbach, and Xiting Zhuang (assistant professor and Ph.D. student, respectively, both in the Department of Agricultural and Resource Economics at the University of Connecticut): “‘Containergeddon' and California Agriculture,” ARE Update 25(2): 1–4. UC Giannini Foundation of Agricultural Economics, online at https://giannini.ucop.edu/filer/file/1640021835/20297/.

ARE Update is a bimonthly magazine published by the Giannini Foundation of Agricultural Economics to educate policymakers and agribusiness professionals about new research or analysis of important topics in agricultural and resource economics. Articles are written by Giannini Foundation members, including University of California faculty and Cooperative Extension specialists in agricultural and resource economics, and university graduate students. Learn more about the Giannini Foundation and its publications at https://giannini.ucop.edu/.

Will California remain leader in U.S. agricultural production?

"California Agriculture: Dimensions and Issues" by the Giannini Foundation of Agricultural Economics details the past, present and future of many of California's major agricultural commodities, including grapes, tree fruits and nuts, vegetable crops, dairy, livestock, nursery and floral production, and cannabis. The new 18-chapter book, written by agricultural economists at UC Davis, UC Berkeley and UC Riverside, addresses issues such as labor, water, climate and trade that affect all of California agriculture.

"California agriculture overcame many obstacles to become the nation's number one farm state. Leading agricultural economists are generally optimistic that California agriculture will continue to thrive in the 21st century, despite continuing large challenges," said Philip Martin, UC Davis emeritus professor of agricultural and resource economics, who is co-editor of the new publication.

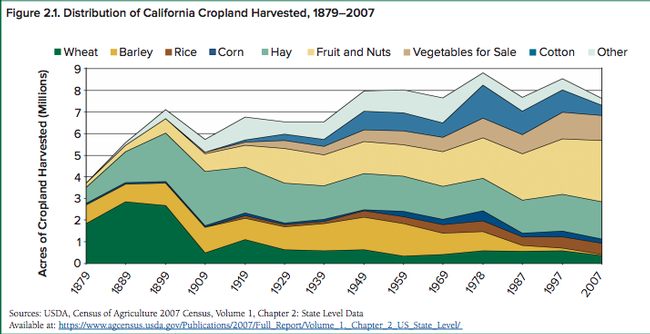

For over 70 years, California has led the nation in farm sales due to its specialization in high-value commodities such as fruits, nuts, vegetables and other horticultural crops. The book uses the most recent Census of Agriculture data to show that, of the $64 billion of these crops produced in the U.S. in 2017, California produced nearly half by value ($31 billion).

More than 44 percent of California's $50 billion in farm sales in 2017 were fruits and nuts, with 17 percent of sales from vegetables and melons, and 14 percent from nursery and other horticultural specialties crops. Many of these high-value specialty crops are also very labor-intensive and face challenges from increased cost and decreased availability of agricultural labor. The book discusses how California growers effectively responded to these labor challenges by adopting labor-saving mechanization. California remains competitive with producers elsewhere by relying on superior plant varieties, integrated pest management, and improved irrigation methods that increase both the quantity and quality of California agricultural commodities.

Water, climate and trade pose challenges and opportunities for California agriculture. In the last decade, water scarcity and decreased water quality, along with regulations to address these issues like the Sustainable Groundwater Management Act, have prompted farmers to use scarce water to irrigate more valuable crops, as with the switch from cotton to almonds. Increased regulations and the increasing scarcity of water affect high-value specialty crops as well as the dairy and livestock industries that accounted for 24% of California farm sales in 2017.

Climate variability, including drought and heat stress, affects farmworker welfare, crop yields and dairy productivity. Retaliatory tariffs resulting from the 2018 trade war reduced U.S. agricultural exports to China by close to $14.4 billion per year, as exports of dairy, livestock and specialty crops fell.

California agriculture has a rich history of overcoming challenges by pursuing innovative research, adopting new technologies, and adapting to changing conditions. Learning how California agriculture has succeeded in the past suggests that the state can maintain its dominant role as an agricultural producer in the future.

Learn more about several of the major California agricultural commodities and the issues and opportunities they face in this new, second edition of California Agriculture: Dimensions and Issues. Read the book for free online as part of the Giannini Foundation's Information Series (20-01) at https://giannini.ucop.edu/publications/cal-ag-book/. A paperback copy of the 414-page book can be ordered for $55 at http://bit.ly/CalAgBook2ndEd.

The Giannini Foundation was founded in 1930 from a grant made by the Bancitaly Corporation (later renamed Bank of America) to the University of California. Its mission is to promote and support research and outreach activities in agricultural economics and rural development to benefit the agricultural industry, policymakers, and society at large. Giannini members include University of California faculty and Cooperative Extension Specialists in agricultural and resource economics. Learn more about the Giannini Foundation of Agricultural Economics at https://giannini.ucop.edu.